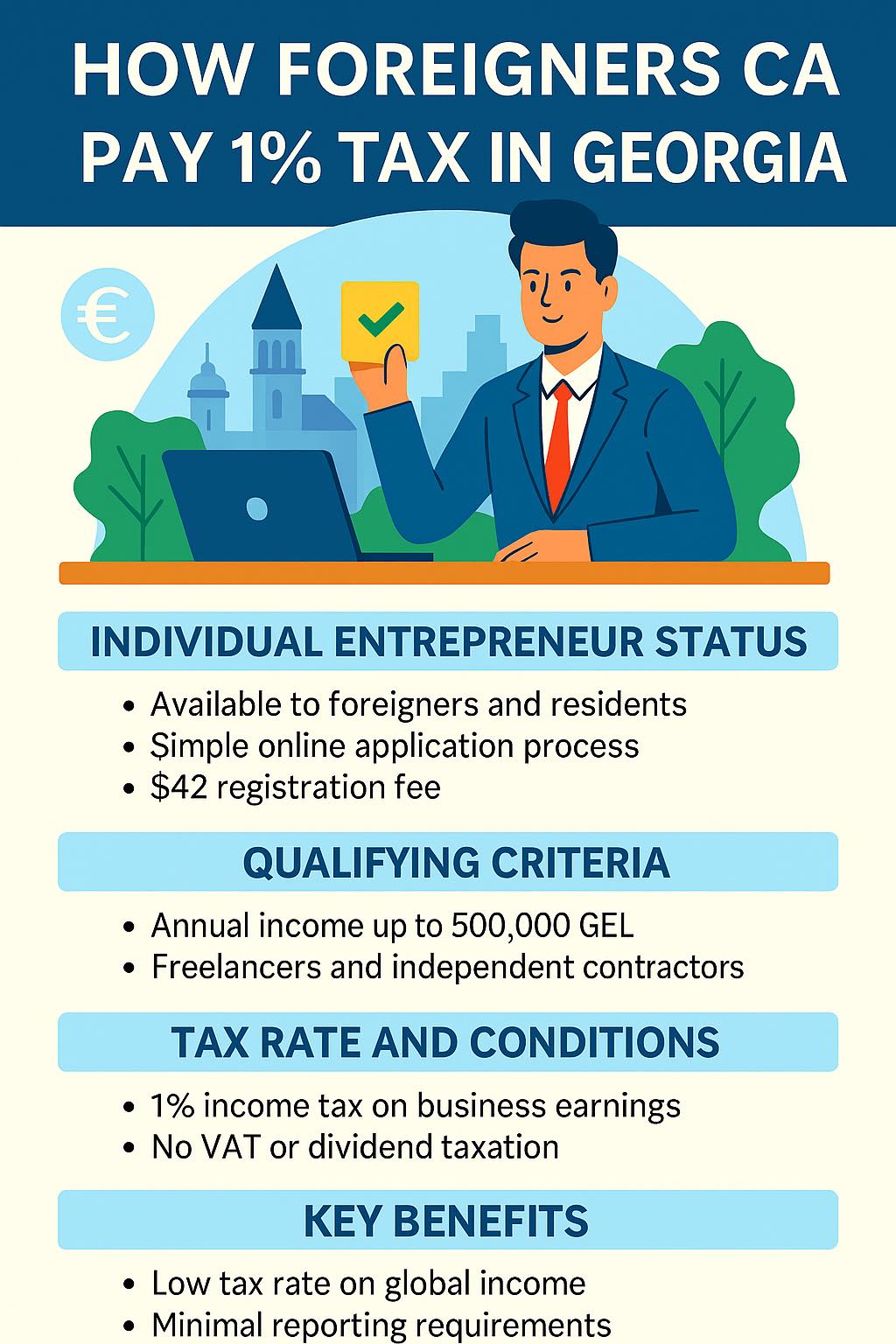

How Foreigners Can Pay 1% Tax in Georgia: If you are a freelancer, entrepreneur, or digital nomad looking for a low-tax destination, Georgia offers one of the most attractive schemes in the world: the Individual Entrepreneur Small Business Status, which allows qualifying foreigners to pay just 1% tax on turnover up to a certain income limit. This guide will walk you through everything you need to know to benefit from this opportunity in 2025.

Why Georgia’s 1% Tax Regime Is So Attractive

Georgia has been gaining global attention for its low taxes, straightforward bureaucracy, and ease of doing business. The 1% tax scheme is particularly appealing because:

- It’s available to foreigners and locals alike.

- It applies to total turnover, not just profit.

- There is no VAT obligation under the threshold.

- Accounting requirements are minimal compared to many other countries.

Who Can Qualify for the 1% Tax in Georgia

To be eligible for the Small Business Status and pay just 1% tax:

- Register as an Individual Entrepreneur in Georgia.

- Annual turnover must not exceed 500,000 GEL (around $185,000 USD).

- Income should come from allowed activities (some professions, like lawyers and architects, are excluded).

- No more than the allowed number of employees under this status.

- Not working as a contractor for a single foreign company that could be considered your employer.

Step-by-Step: How to Get the 1% Tax Rate

Here’s the process for registering and activating your low-tax status:

1. Register as an Individual Entrepreneur

- Visit the Public Service Hall in Georgia.

- Present your passport (and residency permit if applicable).

- Pay the registration fee (around 20 GEL for standard processing).

- Receive your taxpayer identification number.

2. Apply for Small Business Status

- After registration, visit the Revenue Service office or apply online.

- Submit your application for Small Business Status.

- Receive confirmation of your eligibility for the 1% turnover tax rate.

3. Open a Georgian Bank Account

- Choose a bank that supports foreign entrepreneurs (TBC Bank, Bank of Georgia, etc.).

- Use the account for all business-related transactions to maintain clean records.

4. Maintain Monthly Reporting

- File a simple monthly turnover declaration with the Revenue Service.

- Pay 1% of your gross turnover for that month.

- Example: If you earn 10,000 GEL in a month, your tax will be just 100 GEL.

Example of How Much You Save

| Monthly Income | Tax in Georgia (1%) | Tax at 20% Rate |

|---|---|---|

| 5,000 GEL | 50 GEL (~$18) | 1,000 GEL (~$370) |

| 10,000 GEL | 100 GEL (~$37) | 2,000 GEL (~$740) |

| 20,000 GEL | 200 GEL (~$74) | 4,000 GEL (~$1,480) |

Other Benefits of Doing Business in Georgia

- No tax on foreign-sourced income for individuals not qualifying as tax residents.

- No restrictions on currency – you can hold accounts in GEL, USD, EUR.

- Fast and inexpensive company setup.

- Double taxation treaties with several countries.

Important Things to Keep in Mind

- Annual turnover over 500,000 GEL moves you to standard taxation.

- Some professions are excluded – check the official list before applying.

- Keep invoices and payment records for potential audits.

Understanding how Georgia’s 1% tax regime works is only part of the bigger picture when moving here as a foreigner. To make smart financial decisions, it’s helpful to look at the Cost of Living in Georgia’s Top Cities 2025 and see how daily expenses differ between Tbilisi, Kutaisi, and Batumi. If you’re thinking of basing yourself by the coast, our Cost of Living in Batumi 2025 guide gives a clear idea of monthly budgets under the same 1% taxation benefits. Moving around is also affordable and efficient — check the Public Transportation in Batumi article for a breakdown of routes, fares, and the Batumi Card system. And for those taking advantage of Georgia’s tax incentives as remote workers, the Digital Nomad in Tbilisi Ultimate Guide covers everything from coworking spaces to legal residence tips.

Conclusion

For freelancers, consultants, and small business owners, Georgia’s 1% tax regime is one of the easiest and most affordable ways to run a business legally while keeping taxes extremely low. With simple registration, minimal bureaucracy, and a welcoming environment for foreigners, it’s no surprise that Georgia is becoming a hotspot for location-independent entrepreneurs.

📹 Watch our complete guide on registering a business in Georgia here: