Sole Proprietorship in Georgia: Georgia has become an increasingly attractive destination for entrepreneurs and freelancers thanks to its low taxes, straightforward bureaucracy, and business-friendly environment. For those who want to operate as a solo business owner, the sole proprietorship (also called an individual entrepreneur) is one of the simplest legal forms to establish. This guide explains step-by-step how to start a sole proprietorship in Georgia, the requirements, costs, tax obligations, and practical tips for success.

What is a Sole Proprietorship in Georgia?

A sole proprietorship in Georgia, known locally as an Individual Entrepreneur (IE), is a business structure where the owner and the business are legally the same entity. It is ideal for freelancers, consultants, small traders, and service providers who operate on their own or with minimal staff. The registration process is quick, and the accounting requirements are much lighter compared to companies.

Advantages of Registering as an Individual Entrepreneur

- ✅ Low registration cost – Affordable and quick to set up.

- ✅ Simple accounting – Especially if you opt for the Small Business Status.

- ✅ Low taxes – Possible tax rate of just 1% under certain conditions.

- ✅ Foreign-friendly – Non-residents can register without needing citizenship.

- ✅ No minimum capital requirement.

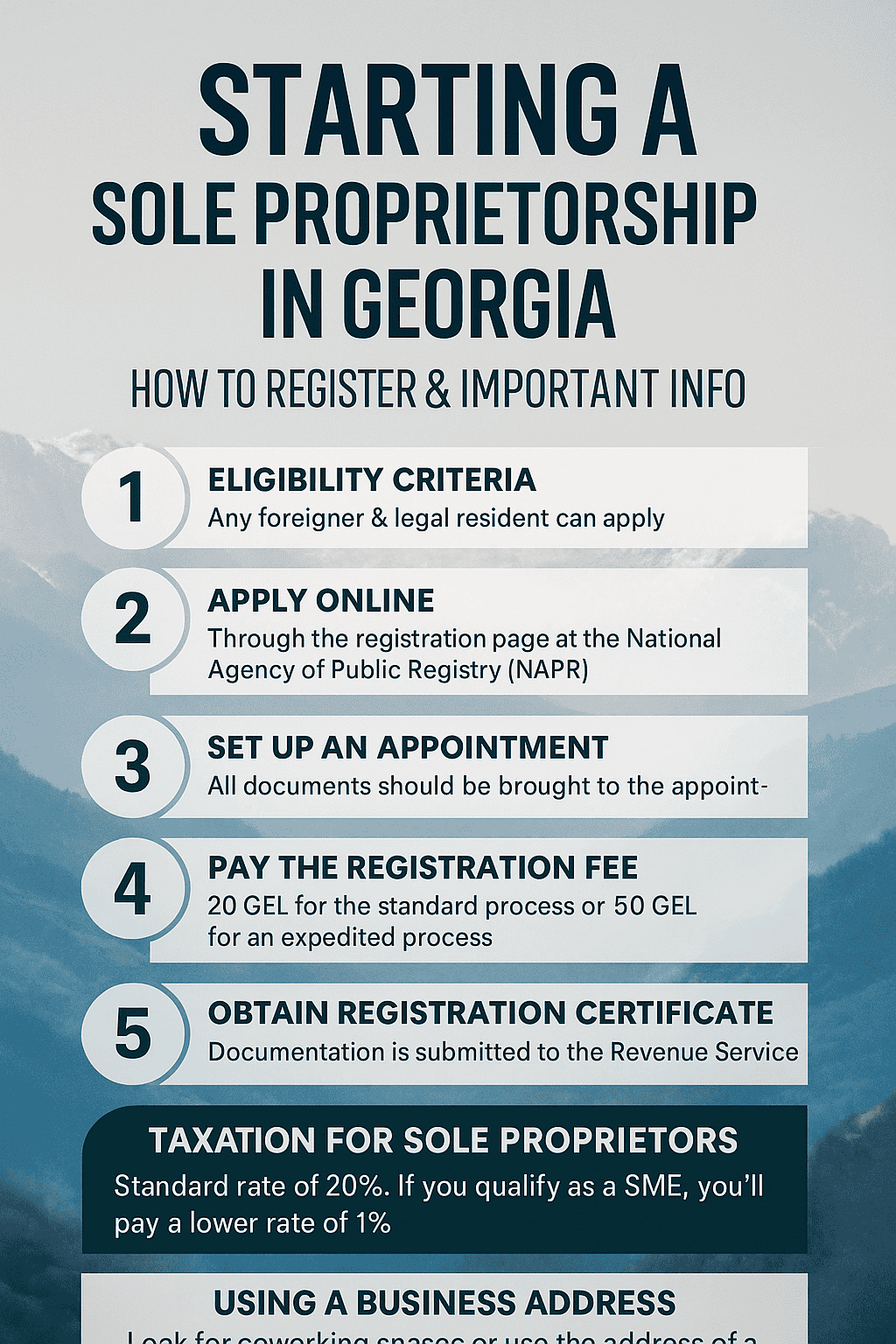

Step-by-Step: How to Register a Sole Proprietorship in Georgia

- Choose a business activity – Decide your main field (IT, marketing, retail, etc.).

- Gather required documents – Passport, local address (can be a rental contract), and application form.

- Visit the Public Service Hall – You can register in person or via a representative with a power of attorney.

- Pay the registration fee – Around 20 GEL for standard processing, 50 GEL for same-day service.

- Obtain your tax identification number (TIN) – Usually issued on the same day.

- Register for Small Business Status (optional) – Apply at the Revenue Service to reduce your tax rate to 1%.

Costs of Starting a Sole Proprietorship in Georgia

| Expense | Cost (GEL) | Cost (USD approx.) |

|---|---|---|

| Registration fee (standard) | 20 | $7 |

| Registration fee (express) | 50 | $18 |

| Translation & notarisation (if needed) | 50–100 | $18–$36 |

| Stamp (optional) | 10–20 | $3.50–$7 |

Taxation for Sole Proprietors in Georgia

As an individual entrepreneur in Georgia, you have different taxation options depending on your annual turnover:

- Small Business Status – 1% tax on turnover up to 500,000 GEL/year.

- Standard regime – 20% personal income tax on profit, plus social security contributions.

It’s crucial to keep monthly records and submit annual declarations to the Revenue Service. Many entrepreneurs hire a local accountant for a small monthly fee (50–150 GEL).

Banking for Sole Proprietors

Opening a business bank account is highly recommended. Georgian banks such as TBC Bank and Bank of Georgia offer dedicated accounts for sole proprietors, often with online banking in English and multi-currency options.

Here’s a complete step-by-step guide on how to open a bank account in Georgia.

Tips for Foreign Entrepreneurs in Georgia

- ✅ Bring your passport and an apostilled address document if using a foreign address.

- ✅ Apply for Small Business Status immediately to save on taxes.

- ✅ Consider using an English-speaking accountant to handle tax filings.

- ✅ Keep receipts and invoices to prove your business activities if audited.

Conclusion

Starting a sole proprietorship in Georgia is one of the fastest and most cost-effective ways to launch a business in the country. With low taxes, minimal bureaucracy, and an open environment for foreigners, Georgia continues to attract digital nomads, freelancers, and small business owners worldwide. By following the steps outlined above, you can be up and running within a single day.